With Bench, enjoy the ease and convenience of online bookkeeping that seamlessly integrates with your store’s operations, ensuring nothing is overlooked. Our tailored services ensure a thorough understanding of your store’s financial health, providing you with the certainty you need to focus on your craft. Accounts payable and its management is important for the efficient functioning of your business.

Should they require any additional information from you, they’ll reach out promptly. Our dedicated team will take the time to fully comprehend your jewelry store’s unique needs and operations. We’ll answer any questions you have, assist you in linking your accounts, and guide you through all the capabilities that Bench can offer your business. Experience seamless bookkeeping, income tax prep, and filing, all taken care of by experts—complemented by one robust platform.

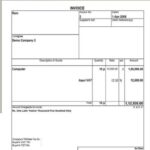

Each category will include specific accounts for your business, like a business vehicle that you own would be recorded as an asset account. In this article you will learn about the importance of a chart of accounts and how to create one to keep track of your business’s accounts. Delaying the payments for a few days would help Walmart Inc to hold more cash to eventually pay to its suppliers. However, delaying payments for too house banking scandal a long of a period would critically impact Walmart’s relationship with its suppliers. Therefore, if your business has only a few accounts payable, you may record them directly in your general ledger.

Analysis of Accounts Payable Turnover Ratio Formula

This can help to reduce your workload at the months-end, and following a uk auditors’ perceptions of inherent risk weekly or a fortnightly accounts payable cycle can help you avoid late payments. Most new owners start with one or two broad categories, like sales and services, it may make sense to create seperate line items in your chart of accounts for different types of income. This is because while some types of income are easy and cheap to generate, others require considerable effort, time, and expense. For instance, 2/10 net 30 is the trade credit that your suppliers offer for the sale of goods or services, meaning you’ll receive a discount of 2% if you pay the amount due within 10 days.

How Bench works with jewelry stores

- The accounting needs transportation businesses are truly unique and we possess the exceptional experience your business requires.

- You must process your invoices on a regular basis, regadless of the number of vendors you have, so you can follow the above procedure either weekly or fortnightly.

- Add an account statement column to your COA to record which statement you’ll be using for each account, like cash flow, balance sheet, or income statement.

- Based on Walmart’s payment schedule, its suppliers can determine the credibility of the company.

- Scott Reid CPAs has experience working with diverse businesses that require a variety of specialized accounting and tax solutions.

Since we typically follow a double-entry bookkeeping system, why would a cash account have a credit balance there has to be an offsetting debit entry to be made in your company’s general ledger. Either an expense or an asset forms part of the debit offset entry in the case of accounts payable. The accounts payable account also includes the trades payable from your business, because this refers to the amount of money that you owe your suppliers for products related to inventory.

It is especially important when firms find it challenging to obtain funding via financial or credit institutions. Since the financial crisis, trade credit in the form of accounts payable and accounts receivable has become a stable source of funding. Add an account statement column to your COA to record which statement you’ll be using for each account, like cash flow, balance sheet, or income statement. For example, balance sheets are typically used for asset and liability accounts, while income statements are used for expense accounts. When confirming accounts payable, your company’s auditors must take a sample of accounts payable.

Accounts Payable Turnover Ratio Formula

Your bookkeeper will be your main point of contact, but at times you might hear from another member of your team. This is usually when your bookkeeper goes on vacation, is sick, or otherwise unavailable. Non-profit accounting from an experienced CPA firm will efficiently manage the fiscal responsibilities of charities, membership organizations, and churches.

And Xero certified advisors and advisors with industry or bank specialisations are not employees of Xero. So often jewelry designers count their inventory as COGS when it’s still in your studio. Mariel suggests looking at it this way, material in your studio is essentially cash in the bank. It’s good to claim every single expense you have in your biz because you pay taxes on your profit, not just sales. Because most jewelry designers have no clue where to start when it comes to setting up their accounting, inventory, and corporate structure. Accountant websites designed by Build Your Firm, providers of CPA and accounting marketing services.